All Categories

Featured

Table of Contents

- – Is there a way to automate Wealth Building Wit...

- – Can Infinite Banking Retirement Strategy prote...

- – Is Infinite Banking Account Setup a good stra...

- – What is the minimum commitment for Wealth Bui...

- – What is the minimum commitment for Self-fina...

- – What happens if I stop using Cash Flow Banki...

- – How do I leverage Infinite Banking Benefits ...

Term life is the best option to a short-term requirement for protecting versus the loss of a breadwinner. There are far less reasons for irreversible life insurance policy. Key-man insurance and as component of a buy-sell arrangement come to mind as a feasible good reason to acquire a long-term life insurance policy plan.

It is a fancy term coined to offer high priced life insurance with enough commissions to the agent and huge profits to the insurer. Infinite Banking benefits. You can get to the same result as limitless financial with far better outcomes, more liquidity, no threat of a policy gap triggering a massive tax obligation issue and even more options if you utilize my choices

Is there a way to automate Wealth Building With Infinite Banking transactions?

Compare that to the predispositions the promoters of infinity financial receive. 5 Mistakes People Make With Infinite Banking.

As you approach your golden years, economic safety is a top concern. Among the many various economic techniques available, you might be hearing even more and more regarding limitless banking. Policy loans. This principle allows simply about any individual to become their own bankers, supplying some advantages and versatility that can fit well right into your retired life strategy

Can Infinite Banking Retirement Strategy protect me in an economic downturn?

The car loan will certainly build up simple interest, however you keep versatility in setting repayment terms. The interest rate is likewise generally less than what you would certainly pay a typical bank. This sort of withdrawal enables you to access a portion of your money value (approximately the amount you've paid in costs) tax-free.

Numerous pre-retirees have worries about the security of unlimited financial, and for good reason. The returns on the cash worth of the insurance policy plans might vary depending on what the market is doing.

Is Infinite Banking Account Setup a good strategy for generational wealth?

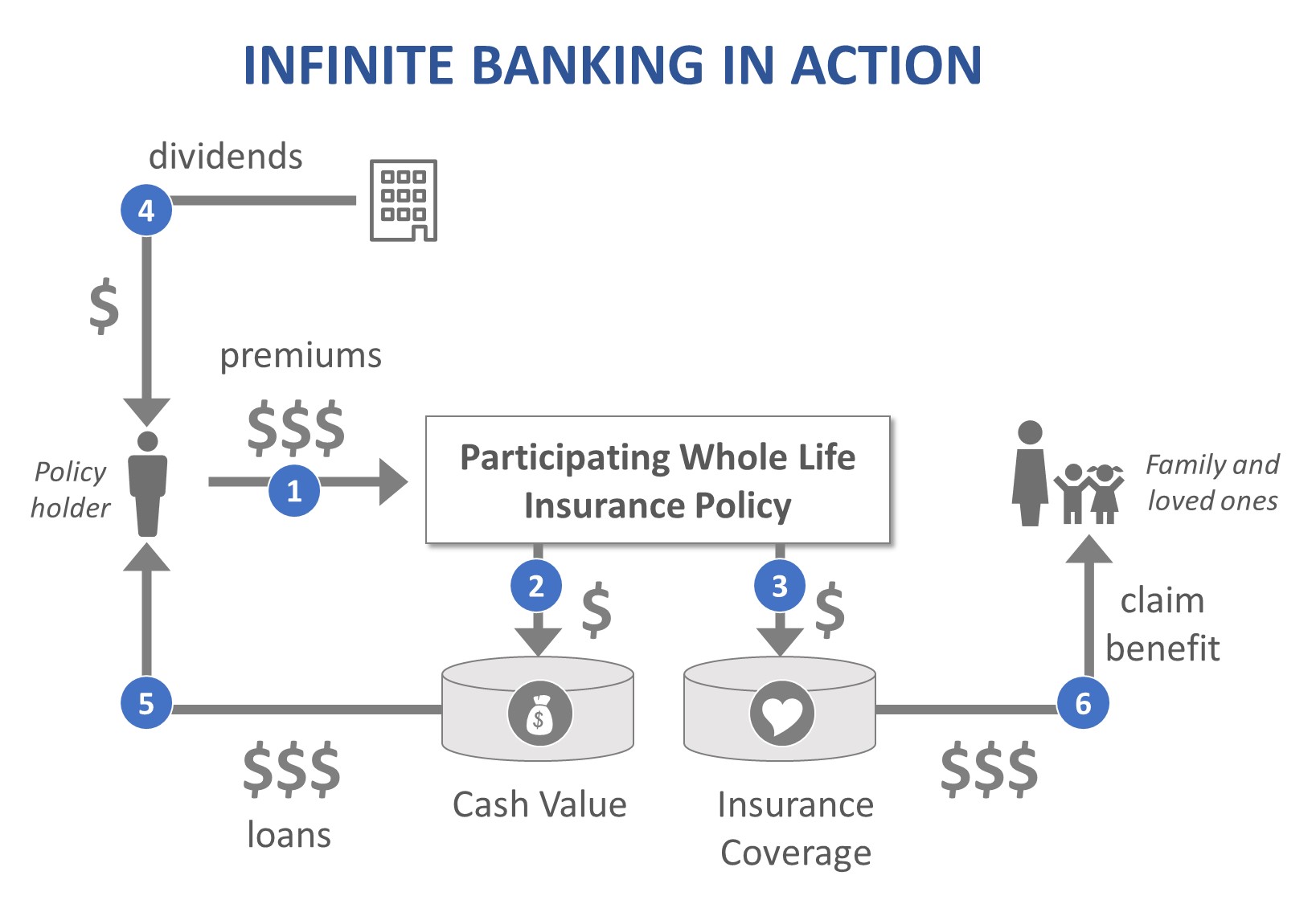

Infinite Banking is a financial strategy that has actually gotten significant interest over the previous few years. It's a special approach to handling individual financial resources, permitting individuals to take control of their money and create a self-reliant financial system - Infinite Banking cash flow. Infinite Banking, likewise referred to as the Infinite Financial Idea (IBC) or the Bank on Yourself technique, is a financial method that includes making use of dividend-paying entire life insurance policy plans to create an individual financial system

To comprehend the Infinite Financial. Idea method, it is as a result important to supply a review on life insurance as it is a very misunderstood possession class. Life insurance policy is a vital part of economic planning that provides lots of benefits. It can be found in many sizes and shapes, the most usual types being term life, entire life, and universal life insurance policy.

What is the minimum commitment for Wealth Building With Infinite Banking?

Term life insurance policy, as its name recommends, covers a details period or term, normally in between 10 to 30 years. It is the most basic and often the most affordable kind of life insurance coverage.

Some term life policies can be renewed or converted into an irreversible plan at the end of the term, yet the premiums typically increase upon revival as a result of age. Whole life insurance policy is a kind of irreversible life insurance policy that provides protection for the insurance policy holder's entire life. Unlike term life insurance, it includes a cash money worth component that grows in time on a tax-deferred basis.

Nevertheless, it is essential to bear in mind that any impressive financings taken against the policy will certainly decrease the death advantage. Entire life insurance coverage is typically more expensive than term insurance coverage since it lasts a lifetime and builds cash worth. It also offers predictable costs, indicating the price will not enhance gradually, supplying a level of certainty for insurance holders.

What is the minimum commitment for Self-financing With Life Insurance?

Some factors for the misconceptions are: Intricacy: Entire life insurance policy policies have much more complex functions contrasted to describe life insurance policy, such as cash value accumulation, dividends, and policy lendings. These attributes can be challenging to recognize for those without a history in insurance or individual money, causing complication and misconceptions.

Predisposition and false information: Some individuals might have had negative experiences with whole life insurance coverage or heard tales from others who have. These experiences and unscientific info can add to a prejudiced sight of entire life insurance coverage and perpetuate misconceptions. The Infinite Financial Idea approach can only be carried out and carried out with a dividend-paying entire life insurance plan with a shared insurance policy business.

Whole life insurance policy is a type of irreversible life insurance policy that gives protection for the insured's entire life as long as the costs are paid. Whole life policies have 2 major parts: a survivor benefit and a money worth (Infinite wealth strategy). The survivor benefit is the amount paid out to beneficiaries upon the insured's death, while the cash worth is a financial savings component that grows in time

What happens if I stop using Cash Flow Banking?

Reward settlements: Common insurer are had by their insurance policy holders, and as a result, they may disperse revenues to policyholders in the form of returns. While returns are not assured, they can aid boost the cash money worth development of your plan, raising the overall return on your capital. Tax obligation advantages: The money value development within an entire life insurance coverage plan is tax-deferred, suggesting you do not pay taxes on the development till you take out the funds.

This can give substantial tax obligation advantages compared to various other financial savings and financial investments. Liquidity: The cash worth of an entire life insurance plan is highly liquid, permitting you to gain access to funds conveniently when required. This can be especially beneficial in emergency situations or unexpected economic scenarios. Property security: In lots of states, the cash value of a life insurance policy plan is protected from financial institutions and legal actions.

How do I leverage Infinite Banking Benefits to grow my wealth?

The policy will certainly have prompt money worth that can be put as collateral thirty days after moneying the life insurance policy policy for a revolving credit line. You will have the ability to accessibility through the rotating credit line approximately 95% of the readily available cash money worth and make use of the liquidity to money an investment that gives income (money circulation), tax benefits, the opportunity for appreciation and leverage of other individuals's ability, capabilities, networks, and capital.

Infinite Financial has become popular in the insurance world - a lot more so over the last 5 years. Lots of insurance coverage agents, all over social networks, insurance claim to do IBC. Did you understand there is an? R. Nelson Nash was the creator of Infinite Financial and the company he founded, The Nelson Nash Institute, is the only organization that formally accredits insurance policy representatives as "," based on the complying with criteria: They straighten with the NNI standards of professionalism and values.

They successfully finish an instruction with an elderly Accredited IBC Practitioner to ensure their understanding and capability to apply all of the above. StackedLife is Licensed IBC in the San Francisco Bay Location and works nation-wide, assisting clients understand and carry out The IBC.

Table of Contents

- – Is there a way to automate Wealth Building Wit...

- – Can Infinite Banking Retirement Strategy prote...

- – Is Infinite Banking Account Setup a good stra...

- – What is the minimum commitment for Wealth Bui...

- – What is the minimum commitment for Self-fina...

- – What happens if I stop using Cash Flow Banki...

- – How do I leverage Infinite Banking Benefits ...

Latest Posts

Infinite Life Insurance

Bank On Yourself: How To Become Your Own Bank

"Infinite Banking" Or "Be Your Own Bank" Via Whole Life ...

More

Latest Posts

Infinite Life Insurance

Bank On Yourself: How To Become Your Own Bank

"Infinite Banking" Or "Be Your Own Bank" Via Whole Life ...